There's a lot going on in India, when it comes to financial payments and settlements.

Launched in 2014, the Pradhan Mantri Jan Dhan Yojana (PMJDY) is the biggest financial inclusion initiative in the world. Digital payments have clearly been witnessing a superfast adoption in India.

But the journey to a $5-trillion economy by FY 2025 will require strong and stable financial infrastructure, and payments and settlements will assume a more crucial role.

The CMS India Cash Vibrancy Report 2023 examines ground reality. Light on rhetoric and heavy on data, it reveals that cash still has a lot of steam. Here are some datapoints.

The Urban-Rural Divide

The urban-rural divide in the Indian financial ecosystem is visible from the growth in the no-frill bank accounts

opened under PMJDY.

The total number of Jan Dhan accounts have grown from 7.07 million (September 2014) to 486.54 million (March 2023). The absolute growth in Rural India is from 4.23 million (September 2014) to 324.5 million (March 2023). In contrast, Urban India saw 2.85 million (September 2014) go to 162.04 million (March 2023).

Rural India contributes around 35% to the country’s GDP. Even while urbanisation is on the rise, the GDP contribution from Rural India is estimated to contribute nearly 25% of the expanded GDP in FY 2030. Rural India is bound to be the biggest enabler for the $5 trillion economy dream to be realised.

Cash still has a lot of steam

Issues such as the unbanked and underbanked population, digital literacy, and internet penetration will keep cash relevant in the longer run.

While 80 million Indian adults made their first digital payment during the pandemic, 70% of account owners in India used cash for merchant payments in 2021 (not cards, neither a mobile phone nor the internet).

Currency in Circulation (CIC)

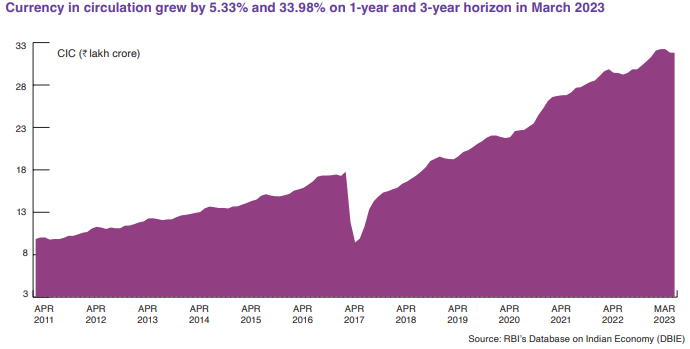

All leading economies have witnessed an expansion in economic activities accelerating their GDP which translates into an increase in monetary liquidity and thus high CIC. At $421 billion in 2021, India saw the third-highest annual growth in CIC.

- UK: 11.76%

- China: 10.19%

- India: 7.95%

After demonetisation in November 2016, CIC witnessed a monthly decline and the lowest CIC was recorded in December 2016.

CIC to GDP

Following demonetisation, there was a sharp decline in CIC to GDP ratio to 8.68% in FY 2017. Subsequently, India’s CIC to GDP ratio has moved in the range of 10.7% to 14.39%.

China saw its CIC to GDP ratio averaging around 10.50% between 2012 to 2016, while the 2017-2021 period saw the ratio averaging around 8.80%.

Automated Teller Machines (ATMs)

FY 2023 saw over 694.5 million debit card-based ATM cash withdrawals which were 7.10% higher over FY 2022.

Interestingly, during the last eight financial years since FY 2016 (April 2015 onwards), Rs 84,934 crore

was withdrawn during December 2016 – the lowest monthly ATM cash withdrawal using debit cards following the

November 8, 2016 demonetisation drive. In March 2023, the ATM cash withdrawal was Rs 2.85 lakh crore. An absolute growth of 235.01% in a matter of 76 months after demonetisation!!

The pan-India ATM cash replenishments carried out by CMS Info Systems witnessed an annual growth of 16.59% in FY 2023.

State-level analysis of ATM cash replenishments reveals that Karnataka saw the highest annual average cash replenishment per ATM, which was 18.14% higher than cash replenished per ATM during FY 2022.

Chhattisgarh saw the second highest cash replenishment of FY 2023, though a decline of 2.10% over FY 2022.

You can access the CMS India Cash Vibrancy Report 2023 to further understand the cash-usage analysis at the global, national, state, and sector levels.