Go-anywhere funds have caught the fancy of many investors, as they have the leeway to invest in equity (across market caps) and debt and gold.

However, when it comes to popularity and scale, clearly, the flexi-cap category rules the roost. The amount of assets managed under this category is Rs 2,52,500 crore, as of April 2023, which is the highest among open-end equity categories.

Kotak Flexi Cap (Rs 37,216 crore), Parag Parikh Flexi Cap (Rs 33,616 crores) and HDFC Flexi Cap (Rs 33,221 crore) are the three largest in terms of assets under management (AUM). The below quarters are as per Financial Year (FY) and not Calendar Year (CY). So Q1FY24 is as on April 2023.

Same ingredients, different dishes

Since the flexi-cap category is limited to the equity asset class, one may mistakenly think of the funds as more industrial than artisanal. Well, that would be wrong because even funds that focus on a single asset class may take dramatically different approaches.

For one, there is no dedicated market cap (as in mid or large or small cap) regulatory guardrail. Therefore, fund managers can move across the market-cap spectrum depending on their view. For instance, DSP Flexi Cap has a large-cap exposure of just 59% while the mid- and small-cap exposure is almost 39%. HDFC Flexi Cap’s large-cap exposure is 84%.

Theoretically, the fund manager has the leeway to go anywhere where opportunity presents itself. Frankly, it sounds a lot easier than it actually is. Imagine the churn in the individual portfolio if the fund manager decides to offload a substantial amount of mid- and small-cap stocks, and buy more of large caps. And later change tack again (as the mandate permits him to). So it is not very surprising to see Kotak Flexi Cap have a low turnover ratio of 6%, while DSP Flexi Cap is on the other end of the spectrum at 57%.

The fund managers have the latitude to stick to a strategy and investment style they are most comfortable with. Some adhere to a pure play growth, others are at home with value, while there are some who follow a GARP (growth at reasonable price) approach. Yet others may have no defined approach but a combination of styles. Couple this with the freedom to move across the market-cap spectrum. Not surprisingly, AMCs typically tend do have their best managers manage this fund; simply because it allows him/her to play to their strengths.

For instance, Atul Bhole at DSP Flexi Cap plies a growth-oriented approach while selecting stocks with little or no heed to valuation. Being benchmark agnostic, he is fine with avoiding a stock if it doesn’t meet all his selection parameters, even if it’s an index heavyweight. While Roshi Jain of HDFC Flexi Cap is benchmark aware. Anil Shah of ABSL Flexi Cap ensures that this investments in off-benchmark stocks typically carry a lower weight compared with benchmark names with a higher exposure.

Like DSP Flexi Cap, Kotak Flexi Cap too has a growth-centric approach. HDFC Flexi Cap runs with a value bent. ABSL Flexi Cap draws more from the top-down approach and fund manager Anil Shah focuses on sectors he believes are attractively valued with growth prospects.

Some may dabble in international stocks too, as does PPFAS.

How different can the dishes really be?

Very different!

As the portfolio is the culmination of the fund manager’s execution skills, preferred strategy and views.

Take for instance UTI Flexi Cap with 27% to Financial Services, while PPFAS has it at 35% (category average: 30%).

Funds like UTI Flexi Cap and DSP Flexi Cap have no exposure to Energy, but Kotak Flexicap and Mirae Flexicap both have it at around 6%.

Some managers may prefer taking a concentrated approach while some may prefer to be diversified with a long tail approach.

Cash holdings vary too. Kotak Flexicap’s cash exposure was a miniscule 0.75%, while PPFAS had it at around 14.43%. The latter has historically had a higher allocation to cash, but the fund manager did admit that there were no good opportunities to deploy the cash meaningfully as they did not find valuations attractive. Prior to the market crash in 2020, the fund had around 11% in cash which was deployed during the crash. The fund did amazingly well in 2020 and 2021.

Be smart when viewing performance.

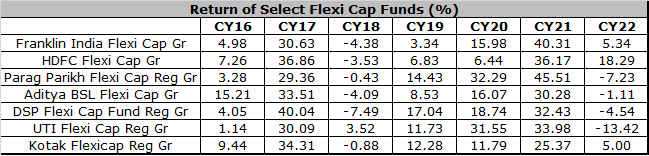

As their individual strategies and portfolios vary dramatically, the return generated will vary too. View performance in conjunction with how the market is rewarding or punishing a particular investing style. So analyse the funds through various market cycles.

Such as the stand-out performance of UTI Flexi Cap in 2018, and its poor run in 2016 as growth stocks took a backseat and cyclicals reigned supreme.

By not owning index heavyweights such as RIL and TCS, Franklin India Flexi Cap could not match the returns of its peers in 2019. Coupled that with the contrarian call on Telecom and investments in Yes Bank and Vodafone Idea.

In 2018, DSP Flexi Cap fell by more than its peers as Bhole’s growth approach with little heed to valuations, was out of favour. When the tide turned, DSP Flexi Cap roared back in 2019, 2020 and 2021. Similarly, investors who would have been patient in HDFC Flexi Cap and Franklin India Flexi Cap through the torrid years of 2018 to 2020, would have been well rewarded thereafter.

What you must consider when analysing a fund:

- Performance track record of the fund manager.

- The fund manager’s experience running that strategy.

- The fund manager’s adherence to his/her style even during challenging times.

- Whether or not the fund is in sync with the rest of your portfolio. Is it complementing your current investments or duplicating them?

Data: Portfolio disclosures as on April 30, 2023. Source: Morningstar Direct

DISCLAIMER

© 2023 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. This research on securities (“Investment Research”), is issued by Morningstar Investment Adviser India Private Limited. Morningstar Investment Adviser India Private Limited (CIN: U74120MH2013FTC249024), having its registered office at Platinum Technopark, 9th Floor, Plot No 17 & 18, Sector - 30A, Vashi, Navi Mumbai, Maharashtra, 400705, is registered with SEBI as an investment adviser (registration number INA000001357), portfolio manager (registration number INP000006156), and research entity (registration number INH000008686).

Morningstar Investment Adviser India Private Limited has not been the subject of any disciplinary action by SEBI or any other legal/regulatory body. It is a wholly owned subsidiary of Morningstar Investment Management LLC, which is a part of the Morningstar Investment Management group of Morningstar, Inc. In India, Morningstar Investment Adviser India Private Limited has only one associate, viz., Morningstar India Private Limited, and this company predominantly carries on the business activities of providing data input, data transmission and other data related services, financial data analysis, software development etc.

The author/creator of this Investment Research (“Research Analyst”) or his/her associates or immediate family may have (i) a financial interest in the subject mutual fund scheme(s) or (ii) an actual/beneficial ownership of one per cent or more securities of the subject mutual fund scheme(s), at the end of the month immediately preceding the date of publication of this Investment Research. The Research Analyst, his/her associates and immediate family do not have any other material conflict of interest at the time of publication of this Investment Research. The Research Analyst or his/her associates or his/her immediate family has/have not received any (i) compensation from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; (ii) compensation for products or services from the relevant asset manager(s)/subject mutual fund(s) in the past twelve months; and (iii) compensation or other material benefits from the relevant asset manager(s)/subject mutual fund(s) or any third party in connection with this Investment Research. Also, the Research Analyst has not served as an officer, director or employee of the relevant asset manager(s)/trustee company/ies, nor has the Research Analyst or associates been engaged in market making activity for the subject mutual fund(s).

The terms and conditions on which Morningstar Investment Adviser India Private Limited offers Investment Research to clients varies from client to client, and are spelt out in detail in the respective agreement. The Investment Research: (1) includes the proprietary information of Morningstar, Inc. and its affiliates, including, without limitation, Morningstar Investment Adviser India Private Limited; (2) may not be copied, redistributed or used, by any means, in whole or in part, without the prior, written consent of Morningstar Investment Adviser India Private Limited; (3) is not warranted to be complete, accurate or timely; and (4) may be drawn from data published on various dates and procured from various sources. No part of this information shall be construed as an offer to buy or sell any security or other investment vehicle. Neither Morningstar, Inc. nor any of its affiliates (including, without limitation, Morningstar Investment Adviser India Private Limited, nor any of their officers, directors, employees, associates or agents shall be responsible or liable for any trading decisions, damages or other losses resulting directly or indirectly from the use of the Investment Research. Investments in securities market are subject to market risks. Read all the related documents carefully before investing. Wherever any securities are quoted, they are quoted for illustration only and are not recommendatory. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The Morningstar Medalist Rating is the summary expression of Morningstar’s forward-looking analysis of investment strategies as offered via specific vehicles using a rating scale of Gold, Silver, Bronze, Neutral, and Negative. The Medalist Ratings indicate which investments Morningstar believes are likely to outperform a relevant index or peer group average on a risk-adjusted basis over time. Investment products are evaluated on three key pillars (People, Parent, and Process) which, when coupled with a fee assessment, forms the basis for Morningstar’s conviction in those products’ investment merits and determines the Medalist Rating they’re assigned. Pillar ratings take the form of Low, Below Average, Average, Above Average, and High. Pillars may be evaluated via an analyst’s qualitative assessment (either directly to a vehicle the analyst covers or indirectly when the pillar ratings of a covered vehicle are mapped to a related uncovered vehicle) or using algorithmic techniques. Vehicles are sorted by their expected performance into rating groups defined by their Morningstar Category and their active or passive status. When analysts directly cover a vehicle, they assign the three pillar ratings based on their qualitative assessment, subject to the oversight of the Analyst Rating Committee, and monitor and re-evaluate them at least every 14 months. When the vehicles are covered either indirectly by analysts or by algorithm, the ratings are assigned monthly.

For more detailed information about the Medalist Ratings, including their methodology, please go to the section titled “Methodology Documents and Disclosures” at http://global.morningstar.com/managerdisclosures.