I am a 75-year old widow. I live with my son and his family. I get a monthly pension of Rs 31,000. I have fixed deposits. I wanted your opinion only on my mutual funds, that I invested on the recommendation of a fund distributor.

The Growth schemes are: Kotak Tax Saver - ELSS (Rs 40,000), UTI Focused Equity Fund – Series V (Rs 20,000), PGIM India Long Term Equity Fund – ELSS (Rs 80,000).

The Dividend schemes are: HDFC Balance Advantage (Rs 26,177), L&T Tax Advantage – ELSS (Rs 40,000), Sundaram Mid Cap (Rs 18,234).

In UTI Master Share Income Option, I have Rs 1.30 lakh.

We answer by framing four questions and answering them.

Q1: Do you need the cash flow from these funds?

- Situation I: You do not need cash flows from these funds to meet your monthly expenses.

In such a situation, we recommend switching to the “Growth” option.

Equities are good long-term investment vehicles and unless there is an explicit need for cash flows, growth option in equity funds is preferable as it helps compound your returns.

Also, given the new taxation norms, dividend is taxed in the hands of the investor, while long-term capital gains on equity is 10%. So if your tax bracket is higher than 10%, it will be advantageous from a tax perspective to be in the growth option.

- Situation II: You need cash flows from these funds to meet your monthly expenses.

In such a situation, we recommend shifting a portion towards fixed-income funds like Short Duration and Corporate Bond funds. You can use the Systematic Withdrawal Plan (SWP) option.

Equities is a volatile asset class which can see dramatic swings in net asset values (NAVs) over the short term, which makes it an unsuitable vehicle to use for generating frequent cash flows. Fixed income funds are inherently less volatile

Q2: Are the funds in the portfolio diversified?

Here is your current asset allocation:

- Bonds: 1%

- Cash: 3%

- Equity: 96%

Here is your current equity allocation:

- Large cap: 72.2%

- Mid cap: 22.1%

- Small cap: 5.7%

As mentioned in the first answer, if you have fixed income investments like fixed deposits, and you do not have any need for monthly expenses or immediate liquidity from these investments, this allocation is fine. Else, we recommend switching to less volatile investments.

Q3: Do the funds in your portfolio overlap?

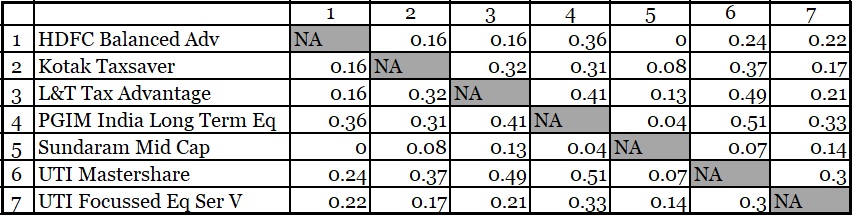

The funds in your portfolio have very little similarity in portfolio holdings between each other which helps with achieving proper diversification.

Use the numbers to understand the portfolio overlap of stocks. For example, HDFC Balanced Advantage and Kotak Taxsaver have an overlap of 0.16. This means that 16% of the portfolio is common between the two funds.

Q4: Do any of the funds need to be changed?

- You have 36.7% allocated to a single fund. UTI Mastershare is a well-managed large-cap fund. But we recommend switching half the allocation to another large-cap fund for diversification purposes. You can choose between Aditya Birla Sun Life Frontline Equity or Mirae Asset Large Cap.

- You can consider exiting the L&T Tax Advantage Fund, after you complete the 3-year exit load period in February 2021. The fund manager has quit recently, and it will be good to evaluate how the fund shapes up under the new manager. You can reallocate that to a large-cap fund.

Registered readers can post their queries by accessing the Ask Morningstar tab. Our team will answer SELECT queries ONLY relating to mutual funds and portfolio planning.

Investment Involves Risk of Loss.