While investing in a fund, investors often overlook the fund’s style. Kaustubh Belapurkar, Director, Manager Research, Morningstar Investment Advisers India, spoke on the CNBC MF Corner show about how investors should interpret different investing styles of funds and their significance. Here are excerpts from this conversation.

Which kind of investing styles exist in a mutual fund?

Three styles typically exist in any fund – value, growth and blend. Fund managers tend to have a bias towards a particular style. They tend to maintain style consistency, regardless of the market cycle.

There will be periods when one particular style will work while another style might lag behind. Thus, investors need to build an all-weather portfolio by mixing these unique investment styles to diversify their portfolios.

How do fund managers filter value stocks?

Value investing style has been around for a long time and has evolved. There are different schools of thought when it comes to value investing. Essentially, you are buying a stock that is cheaper than its intrinsic value. The traditional screeners are Price to Equity, Price to Book, Price to Cash Flow and Price to Sales. Value stocks will typically have a higher dividend yield compared to the market. Besides these screeners, fund managers analyse a number of factors while filtering a value stock. A stock might be attractively valued but it should have a good future prospect. A stock might be facing selling pressure due to some negative news, but its fundamentals may be intact. Value investors try to hunt for such companies that are currently facing headwinds or are out of favour. Fund managers use discounted cash flow analysis of the future earnings of the company to ascertain if the stock is worth buying. These companies are typically undervalued but fundamentally strong and under-owned.

How do growth fund managers filter stocks?

Growth managers typically focus on the earnings growth capacity of the stocks. The idea is to find companies which have grown consistently in the past and would continue to do so going forward. Besides earnings, managers try to look at metrics such as cash flow and sales. The quality of earnings is good in growth stocks. Fund managers expect growth stocks to record earnings growth at a higher than industry average and at a reasonable rate. The ratios such as P/E and P/B will typically be higher for such stocks. This is a popular segment of the market so you will see higher valuation multiples. Growth stocks are very popular which a lot of investors would be able to relate to.

Why wouldn’t all fund managers invest with a blend style which is a mix of growth and value?

Every manager has his/her own skill sets for picking stocks. You will see that the quality growth bias style has done reasonably well over the last couple of years. This strategy didn’t do well in 2015-16. Growth managers stuck to their guns and played out that cycle. Fund managers don’t chase cycles. Fund managers who have the conviction in their style stay invested in multiple market cycles and are rewarded in the future. Value and growth are two extremes. A blend manager will buy into stocks that are not entirely undervalued, nor are they seeing a heady growth. Suppose there is number one stock in a particular sector, the growth at a reasonable price, or GARP, manager would underweight that stock because everyone is looking at that stock. The second stock in that particular sector may be growing at a slower pace than the leader and could have a reasonable valuation. So a GARP manager would invest in such stocks that are reasonably priced. Peter Lynch of Fidelity made GARP style popular among the investment community.

How can retail investors recognise the style of a fund?

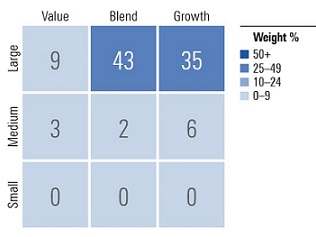

Investors can ascertain the style through the style box, which is pioneered by Morningstar. It is a nine-grid box which tells you what style and capitalisation a fund manager is tilted towards. The vertical side reflects the size or market capitalisation while the horizontal side shows the style. You can also get a breakdown of how much percentage of the fund’s portfolio is invested in each of these nine boxes, which is shown below.

You can also find out if the fund manager has stayed put in a style or has changed his/her style by looking at the historical portfolio. Do note that if you have a value manager, his/her fund will not be depicted fully in the value style box. It could be tilted towards blend. Similarly, a growth fund manager’s portfolio would be slightly tilted towards blend and not so much towards the value box.

What risks value, blend and growth styles exhibit?

If you invest in a value fund, you require patience as this style may go out of favour in some periods. You have to identify such value opportunities early and stay invested till that thesis plays out. There are value traps one needs to be aware of. Fund managers don’t buy stocks just because they are currently priced cheap because there could be something inherently wrong with the company, which is reflected in the stock price.

The problem with growth style of investing is that you could enter at a time when the valuations are high. Growth managers look at forward estimates which may or not play out as per their assumptions.

The challenge in blend style is finding enough stocks which are expected to grow at a reasonable rate and available at reasonable valuations. Thus, the investment universe could be narrow in blend style.

What would be your advice to investors who might be scared by volatility?

A portfolio needs to be looked at holistically. Sectors like healthcare, information technology, FMCG and power didn’t do well in 2017 while consumer durables, metals and capital goods themes did well in the same year. The fund managers who had invested in sectors which performed badly in 2017 stuck to their conviction and in 2018 they were rewarded as IT and FMCG bounced back. Investors often come in when certain funds/theme do well and expect such performance to continue ahead. It is not that the fund has become bad. One needs to set investors expectations right.

What proportion investors should ideally hold in each style?

India is largely a growth market. So a large portion can be invested in growth and blend style. One needs to have a longer-term horizon while investing in value funds as they can be volatile in the short run.