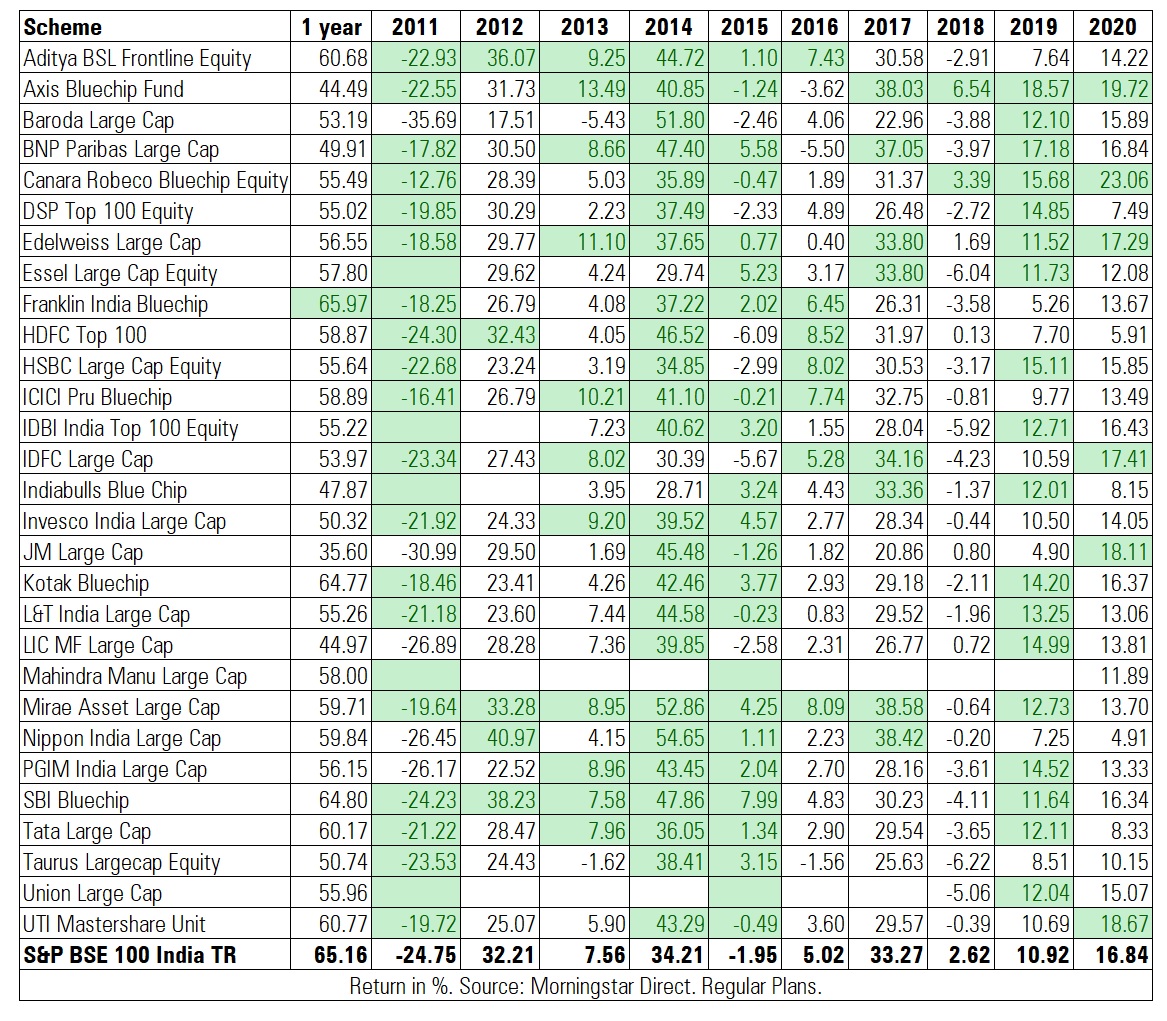

Large cap funds have been finding the going tough. Over a one year period, only one fund - Franklin India Bluechip was able to beat the S&P BSE 100 Index. The fund delivered 65.97% return as on April 9, 2021. During this time, S&P BSE 100 Index delivered 65.16%. In calendar year 2020, only six out of 29 large cap funds outperformed the benchmark.

These funds invest a minimum of 80% in 100 largest firms in terms of market capitalisation. The large cap funds category has delivered 56.78% over a one year period.

The table below illustrates the returns of large cap funds calendar year wise since 2011. Green cells indicate that these funds have outperformed the S&P BSE 100 Index during that year.

Before recategorization norms came into force, funds had the leeway to move across market caps and hence many funds were able to outperform the benchmark. After the implementation of recategorization norms, fund managers have to stick to the templated mandate of investing in different market capitalisations, 80% minimum in large caps in this case. Further, all funds are now benchmarked against total return index, which includes dividends, which has made outperforming the benchmark a challenge. This is paving way for a plethora of passive fund launches in the large cap space.

Here is an overview of two bronze rated large cap funds by our analysts.

Nippon India Large Cap

- Star Rating: 2 stars

- Analyst Rating: Bronze

- Fund Manager: Sailesh Raj Bhan

- Inception: August 2007

- Return: 53.03% (1 year), 6.84% (3 year), 12.07% (5 year), 11.50% (10 year), 10.47% (since inception). Returns as on April 12, 2021.

- Analyst: Himanshu Srivastava

- Date of Analysis: December 2020

- Number of stocks: 40

- Assets in top 10 holdings: 56%

- Assets under management: Rs 10,069 crore

- Expense Ratio: 1.88% (regular plan)

-

Fund Overview

Sailesh Raj Bhan plies a growth-at a reasonable-price strategy. Typically, he prefers companies with healthy or rising returns on equity. He does not mind paying more for a stock if he believes it has sustainable advantages and good growth prospects. But that is not to suggest he is indifferent to valuations. For instance, he has either steered clear of/maintained an underweight position in the consumer defensives sector for a long time because of valuation concerns.

Bhan pays heed to qualitative issues when evaluating a company. He uses fundamental research to scout for companies with sustainable business models, strong management teams, and durable competitive advantages. The top down approach isn’t ignored as factors such as interest rates and currency movement are considered, especially while investing in sectors such as technology, healthcare, and financial services.

Sell-side research is used in the large-cap space, whereas the analyst team puts more emphasis on tracking small/mid-cap stocks. At its core, the process is uncomplicated. However, Bhan’s free flowing investment approach and his willingness to be patient with his high-conviction yet underperforming holdings contribute to this being a unique process.

Mirae Asset Large Cap

- Star Rating: 5 stars

- Analyst Rating: Bronze

- Fund Manager: Harshad Borawake & Gaurav Misra

- Inception: April 2008

- Return: 54.50% (1 year), 11.21% (3 year), 15.46% (5 year), 14.42% (10 year), 15.30% (since inception). Returns as on April 12, 2021.

- Analyst: Nehal Meshram

- Date of Analysis: September 2020

- Number of stocks: 54

- Assets in top 10 holdings: 58%

- Assets under management: Rs 23,762 crore

- Expense Ratio: 1.64% (regular plan)

-

Fund Overview

The fund was recategorised as a large-cap offering since May 2019. However, the change is not a concern given the fund's historical large-cap tilt with a focus on high-growth companies at reasonable prices. The investment philosophy of the fund is built on three core principles: quality businesses with stable earnings, strong management, and attractive valuation.

The process includes both quantitative and qualitative stock screening with bottom-up stock-picking. The sector selection is done through a top-down approach mainly based on growth prospects. Analysts then assess stocks at the industry and company levels and focus on key drivers such as returns on capital employed, returns on equity, and EBITDA margin. Within the framework, there is a lot of emphasis on qualitative analyses like management quality and execution capabilities. These are quantified by evaluating the trailing 10-year track record, which helps in removing subjectivity.

There is a further focus on valuation, which becomes a key driver behind entry and exit timing. This valuation process along with quantitative factors drive the conviction level in the stock, which helps to exclude companies where business fundamentals are not solid. Meeting with company management is vital here to gain company-specific and industry information. The strategy holds a well-diversified portfolio with a long-term perspective, helping performance.

© 2020 Morningstar. All rights reserved. The Morningstar name is a registered trademark of Morningstar, Inc. in India and other jurisdictions. Research on securities, referred to for the purpose of this document as “Investment Research”, is issued by Morningstar Investment Adviser India Private Limited, which is registered with SEBI as an Investment Adviser (Registration number INA000001357), providing investment advice and research, and as a Portfolio Manager (Registration number INP000006156). For the complete disclaimers, click here.