Quantitative investing is picking pace globally. James Harris Simons, the founder of Renaissance Technologies, earned the moniker of best money manager on earth for delivering more than 66% annualized return before fees and 39% after fees over a 30-year span from 1988 to 2018 for Medallion Fund. The firm uses mathematical and statistical methods and is currently open only to RenTech’s employees and a few other people connected to the firm.

This method of investing applies computer models and algorithms and other vast sets of data to predict future security prices. Thus, it eliminates the human-error component, including emotional or cognitive biases that come up while investing. That said, the quant models are themselves designed by humans.

Quant funds apply rule-based investing to shortlist and build a portfolio of stocks. In such funds, fund manager’s role is minimal as the fund uses a number of pre-determined filters to pick stocks. Fund managers review the model annually and make tweaks, if necessary.

“Even the most experienced fund managers often fall prey to behavioural biases which impact decision-making. Hence in the case of factor investing or quant funds, the fund manager creates pre-defined formula or rules. At the time of setting up those rules, a lot of fundamental research and analysis is done, but once that process is completed, there is no ongoing research and hence then there is no human bias involved by the fund manager on a day to day basis for events such as individual results announcement, etc. leading to a change in the portfolio construct. Instead, the rules are constantly monitored and optimised over a period of time. On a daily basis in between two rebalance periods, the fund manager will focus on closest replication to the model portfolio, low tracking error, managing flows smoothly, making sure execution of trades happen with least impact cost,” says Anil Ghelani, Head of Passive Investments & Products, DSP Mutual Fund.

A study conducted by Morningstar in 2015 revealed that 65% of alpha comes from exposure to broad market factors such as value, momentum, yield, volatility, liquidity, size (primarily quantitative factor-based investing) while the remaining 35% comes from stock selection (fundamental analytics & human judgment).

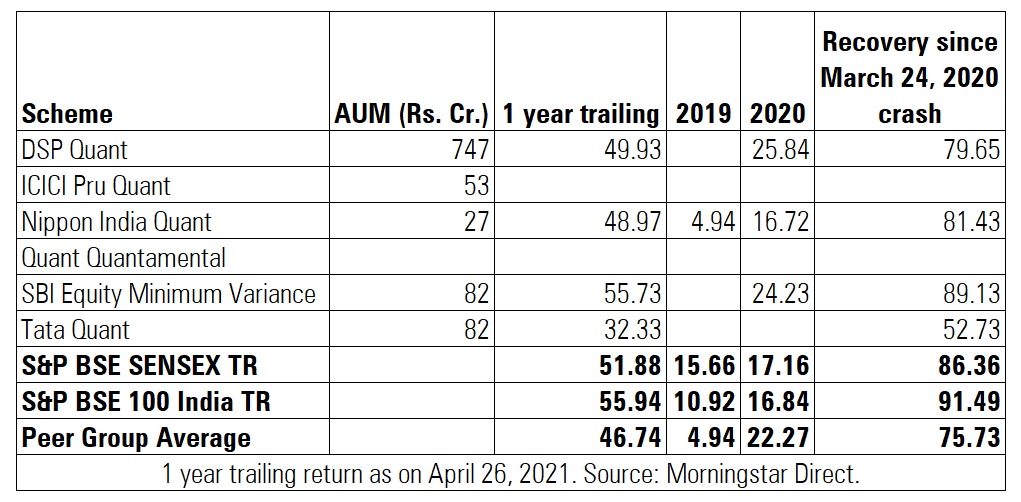

In India, there are five funds that operate on quant model. They collectively manage assets worth Rs 990 crore. Of late, quant based funds have been launched in the form of smart beta funds which apply either a single factor (equal weight/low volatility) or multiple factors like quality, size, and so on.

Read more about factor-based investing here.

Once a model is constructed, quant funds follow the recommendations set by the strategy. They intervene by adding or removing stocks in exceptional circumstances such as company takeover. “It is completely process-oriented and free from fund manager bias. That said, the strategy should be transparent otherwise if it’s a Blackbox, the process can be tinkered with. The strategy can change once the fund starts underperforming,” says Saurabh Mittal of Circle Wealth Advisors.

Let’s take a look at Quant Funds, how they are structured and their performance.

DSP Quant Fund

The fund eliminates companies with high debts, inefficient capital allocation or stocks that indicate high volatility. In the second step, companies are evaluated on factors such as quality (return on equity, earnings, etc), Value (dividend yield, free cash flow yield, etc) and Growth (Estimated earnings growth, etc). After this, each selected stock is weighted appropriately to reduce stock & sector concentration and liquidity risk.

ICICI Prudential Quant Fund

ICICI Prudential Quant Fund follows a three-step process to shortlist stocks. In the first step, it eliminates stocks from the universe based on not meeting the requirement of the parameters. In the second step, it shortlists companies based on various macro, fundamental and technical factors. Finally, it arrives at a composite score for each company by giving equal weights to each parameter and builds a portfolio of 30-60 stocks.

Nippon Quant Fund

It is an actively managed fund that selects stocks based on a proprietary system-based model. The model shortlists 30-35 from S&P BSE 200 index through a screening mechanism at pre-determined intervals, i.e. on a quarterly basis. Stocks are selected on the basis of parameters like valuation, earnings, price, momentum and quality.

Quant Quantamental Fund

Quant has launched a new fund called Quantamental Fund which uses a mix of fundamental, quantitative, predictive analytics and behavioural analytics to select stocks. The fund will invest up to 20% in overseas stocks. It uses Valuation, Liquidity Analytics, Risk Appetite Analytics and Time (VLRT) framework to select stocks. It uses a number of proprietary indicators such as liquidity, market breadth, equity flow, volatility indices, equity ETF flows, selling intensity, risk appetite, bearish bets, fear index, long buildup indicator, and so on while deciding on the allocation to stocks.

SBI Equity Minimum Variance Fund

This fund invests in a diversified basket of companies in Nifty 50 Index while aiming for minimizing the portfolio volatility. The parameters used for selecting and allocating weightage to the stocks is a combination of risk & factor-based parameters like portfolio volatility, correlation & covariance.

Tata Quant Fund

Tata Quant Fund uses a multi factor investment model. It has embedded Artificial Intelligence modules that dynamically change factor strategies basis prevailing market conditions. The fund analyses past economic data like GDP, interest rates, etc., and market conditions like index returns. It uses a machine-learning algorithm used to predict the factor combination that will outperform in the forthcoming month. It periodically rebalances the portfolio on the basis of the latest economic and market information. This fund claims that is flexible in terms of selection of optimal portfolio which learns from new economic and market conditions and makes its own decision about the optimal portfolio.

Should you invest?

Advisers say that rule-based funds can be recommended in the large cap space, where fund managers are finding it difficult to outperform the index. “The concept of many thematic quant/rule-based funds is fairly new in India and each of these funds is tailor-made with different rules. Thus, investors will need to properly understand the fund model and look at the underlying benchmark for its market capitalisation positioning before investing. Just like active funds, investors should know these funds too may and may not outperform. Currently, I believe quality active fund managers investing across various market capitalization especially in the mid and small cap space both in India and abroad have immense room to generate alpha. Observing the underperformance gap in the active large cap segment, large cap quant/rule-based funds after understanding their model can certainly replace underperforming active large cap funds,” says Mumbai-based Mutual Fund Distributor Rushabh Desai.

Nisreen Mamaji of Moneyworks is of the view that quant funds have not generated superior returns. “Quant funds follow a quantitative approach based on historical backtesting. Therefore, they might lose out on qualitative data such as management quality, process, and other intangible assets, and so on. Their performance has not been so superior. Compared to Exchange Traded Funds or Index Funds they charge a higher fee.”

Rushabh says that we can’t write off these funds as such strategies have immense potential going ahead. “Technically there are two types of quant/rule-based funds, one which comes under the thematic category and another which are commonly known as index/passive funds. To keep investor’s portfolios simple, uncomplicated and at low cost, I prefer quant/rule-based index/passive funds over thematic ones. This does not mean thematic quant/rule-based funds are bad, these funds have huge potential in the future as rules, AI technology and Indian markets develop and become more mature.”

Most of these funds don’t have a long track record. Since the fund manager’s involvement in the scheme is minimal, these funds charge a lower expense ratio in comparison to other actively managed funds. Some funds track the BSE 200 Index, while others track Nifty 50 and Nifty 500 Index.

In the calendar year 2020, Quant Funds have outperformed large cap and flexi cap category. In CY 20, large cap category delivered 15.21% while Quant Fund category delivered 22.27%. In CY 2020, flexi cap funds category average return stood at 17.09%.

“It can be recommended for a part of the portfolio as quant funds can work well for large caps with deep markets and long trading history. However, these funds may not work for mid and small caps. Bottom-up stock picking still works in the mid and small cap space,” says Mumbai-based RIA Kavitha Menon.

Quant Funds were not able to beat small and mid cap funds. In CY 2020, small cap category delivered 32.34% while mid cap category yielded 25.76% in comparison to 22.27% delivered by Quant funds.