Mid and small cap funds category constitute 20% or Rs 2.58 lakh crore of the total Rs 13.06 lakh crore actively managed equity assets (excluding hybrid and ELSS) as of December 2021.

Small Cap funds category delivered an average of 59.33% while Mid Cap Funds posted 41.30% during the one-year trailing period as of February 2, 2022.

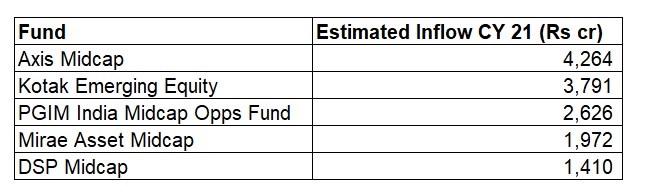

We looked at Small and Mid Cap funds that have received the highest net inflows in 2021.

5 Mid Cap funds that received the highest inflows in 2021

Axis Midcap

- Inception: February 2011

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 11.33% (2019), 26.01% (2020), 39.93% (2021)

- Equity holdings: 65

- % of assets in top 10 holdings: 32

- Top 5 holdings: Coforge, ICICI Bank, Cholamandalam Investment and Finance, Avenue Supermarts, MindTree

- Fund managers: Shreyash Devalkar, Hitesh Das

- Investment Style: Large Growth

Kotak Emerging Equity

- Inception: March 2007

- Star rating: 4 stars

- Analyst rating: Bronze

- Performance: 8.89% (2019), 21.89% (2020), 47.31% (2021)

- Equity holdings: 68

- % of assets in top 10 holdings: 33

- Top 5 holdings: Persistent Systems, Supreme Industries, Schaeffler India, Thermax, SKF India

- Fund manager: Pankaj Tibrewal

- Investment Style: Mid Growth

PGIM India Midcap Opportunities

- Inception: December 2013

- Star rating: 4 stars

- Analyst rating: NA

- Performance: 3.57% (2019), 48.39% (2020), 63.78% (2021)

- Equity holdings: 49

- % of assets in top 10 holdings: 32

- Top 5 holdings: Mphasis, Coforge, ICICI Bank, J.B. Chemicals & Pharmaceuticals, ABB India

- Fund manager: Aniruddha Naha, Vivek Sharma

- Investment Style: Mid Growth

Mirae Asset Mid Cap Fund

- Inception: July 2019

- Star rating: NA

- Analyst rating: NA

- Performance: 24.28% (2020), 48.43% (2021)

- Equity holdings: 52

- % of assets in top 10 holdings: 29

- Top 5 holdings: Axis Bank, The Federal Bank, Jindal Steel and Power, Bharat Forge, Voltas

- Fund manager: Ankit Jain

- Investment Style: Large Growth

DSP Midcap Fund

- Inception: November 2006

- Star rating: 3 stars

- Analyst rating: Silver

- Performance: 9.21% (2019) 23.64% (2020), 28.32% (2021)

- Equity holdings: 52

- % of assets in top 10 holdings: 32

- Top 5 holdings: Supreme Industries, Manappuram Finance, Atul Ltd, Ipca Laboratories, SBI Life Insurance

- Fund Manager: Vinit Sambre, Resham Jain, Jay Kothari

- Investment Style: Mid Growth

5 small cap funds that received the highest inflows in 2021

Kotak Small Cap

- Inception: February 2005

- Star rating: 3 stars

- Analyst rating: NA

- Performance: 5.04% (2019) 34.21% (2020), 70.94% (2021)

- Equity holdings: 70

- % of assets in top 10 holdings: 36

- Top 5 holdings: Century Plyboards (India), Sheela Foam, Carborundum Universal, Persistent Systems, Supreme Industries

- Fund manager: Pankaj Tibrewal

- Investment Style: Mid Growth

Axis Small Cap

- Inception: November 2013

- Star rating: 5 stars

- Analyst rating: NA

- Performance: 19.38% (2019) 22.37% (2020), 58.22% (2021)

- Equity holdings: 65

- % of assets in top 10 holdings: 38

- Top 5 holdings: Galaxy Surfactants, Birlasoft, Brigade Enterprises, Narayana Hrudayalaya, Tata Elxsi

- Fund managers: Anupam Tiwari, Hitesh Das

- Investment Style: Mid Growth

SBI Small Cap

- Inception: September 2009

- Star rating: 4 stars

- Analyst rating: NA

- Performance: 6.10% (2019) 33.62% (2020), 47.56% (2021)

- Equity holdings: 50

- % of assets in top 10 holdings: 34

- Top 5 holdings: Sheela Foam, Elgi Equipments, Blue Star, Carborundum Universal, Hatsun Agro Product

- Fund manager: R Srinivasan

- Investment Style: Mid Growth

PGIM India Small Cap

- Inception: July 2021

- Star rating: NA

- Analyst rating: NA

- Performance: 16.70% (since inception)

- Equity holdings:53

- % of assets in top 10 holdings: 32

- Top 5 holdings: J.B. Chemicals & Pharmaceuticals, Persistent Systems, Timken India, Krishna Institute of Medical Sciences, Coforge

- Fund managers: Aniruddha Naha, Ravi Adukia, Kumaresh Ramakrishnan

- Investment Style: Mid Growth

Quant Small Cap

- Inception: September 1996

- Star rating: 4 stars

- Analyst rating: NA

- Performance: - 23.51% (2019), 75.10 (2020), 88.05% (2021)

- Equity holdings: 51

- % of assets in top 10 holdings: 43

- Top 5 holdings: ITC, Indiabulls Real Estate, Arvind Ltd, HFCL Ltd, IRB Infrastructure Developers

- Fund managers: Sanjeev Sharma, Vasav Sahgal, Ankit Pande

- Investment Style: Mid Blend

Data Source: Morningstar Direct.