Hybrid Funds have emerged as a saviour in volatile markets for risk-averse investors.

We looked at the data from January 2018 when the recategorization norms came into force. Before recategorization, there was no regulatory requirement to invest a minimum/maximum in equity and debt.

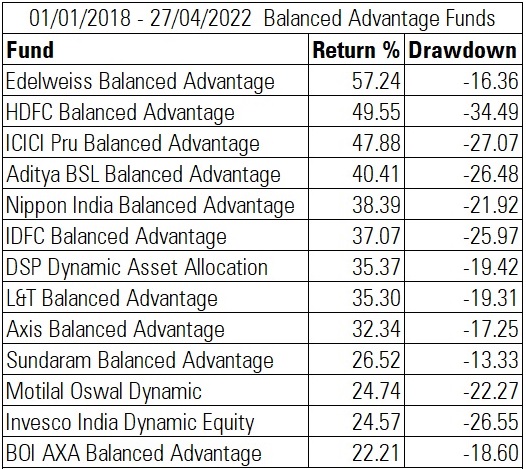

From January 2018 till April 27, 2022, the S&P BSE 500 has seen a drawdown of -38.11% while the Balanced Advantage Funds or Dynamic Asset Allocation Funds category saw an average drawdown of -22.34%.

Performance of different types of Hybrid Funds from the implementation of categorization norms in 2018:

Before you jump in to invest in these funds, it is important to understand their construct and extent of equity exposure. These funds are not completely immune to volatility and can even deliver negative surprises, especially where the fund takes an aggressive exposure towards equity when the market is falling.

There are seven types of Hybrid Funds. Take a look at how they differ in this article. 7 types of Hybrid Funds

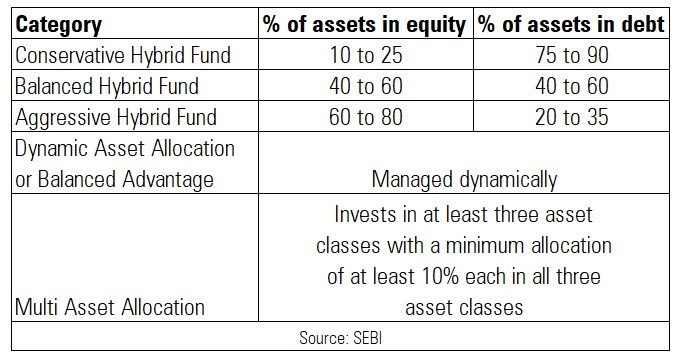

Threshold of exposure in equity and debt

From January 2018 till April 27, 2022, the largest drawdown among the Balanced Advantage Fund/Dynamic Asset Allocation category was witnessed by HDFC Balanced Advantage Fund (-34.49%) while it clocked a return of 11.90% compound annual growth rate (CAGR).

On the other hand, Sundaram Balanced Advantage saw the least drawdown of -13.33%, clocking 5.82% CAGR during the same period.

As you can see, two funds within the same category can have vastly different return and risk profile, depending on the investment style and equity/debt exposure. HDFC Balanced Advantage Fund is run with a value style with large cap bias. Sundaram Balanced Advantage Fund follows a growth investment style.

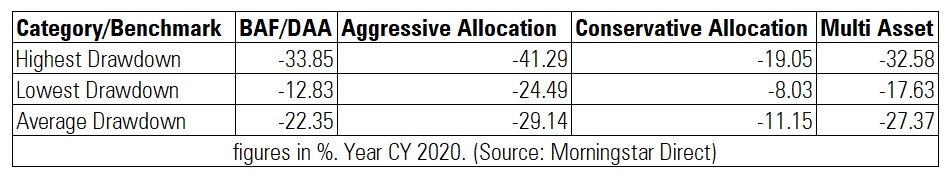

Performance during 2020 pandemic led crash

Balanced Advantage Funds/Dynamic Asset Allocation

The Corona virus induced lockdown sent shockwaves across the global financial markets and India was not immune. In CY 2020, the broader indices like BSE Sensex and BSE 500 dropped by -38.11% while BAF category saw an average drawdown of -22.35%, which provided downside protection of 15.76 percentage points.

The fund which witnessed the maximum drawdown was ITI Balanced Advantage Fund (-33.85%), while the fund which saw the lowest drawdown was Sundaram Balanced Advantage (-12.83%) in CY 2020.

The fund which delivered the highest return in CY 2020 was Baroda BNP Paribas Balanced Advantage Fund, clocking 26.21% return while it saw a drawdown of -20.80%. The only fund which delivered a negative return in this category was ITI Balanced Advantage Fund which delivered -9.83%. ITI Balanced Advantage Fund was launched in December 2019.

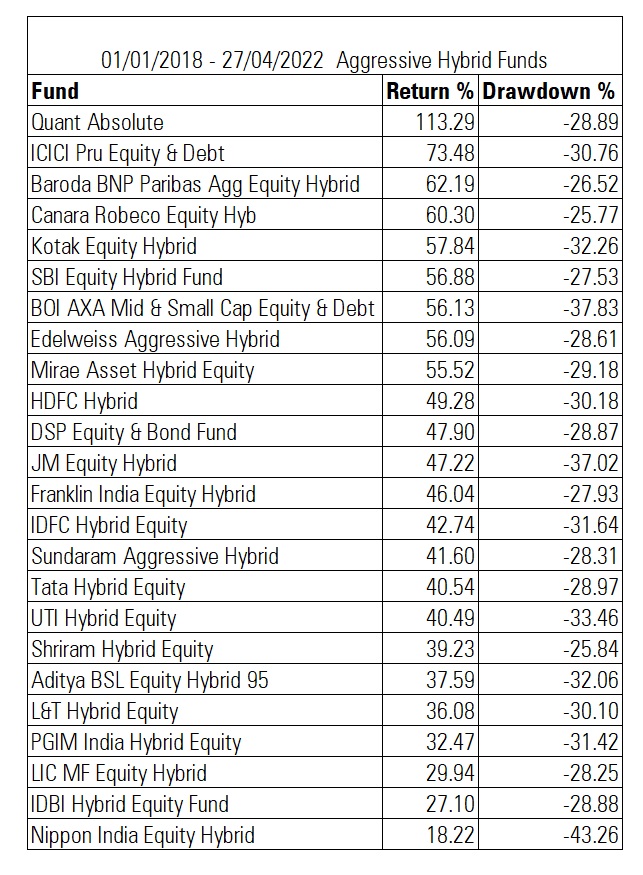

Aggressive Allocation

These funds have the leeway to invest in the range of 60% to 80% in equities while the debt portion can range from 20% to 35%.

In CY 2020, the fund which witnessed the maximum drawdown (-41.29%) was Nippon India Equity Hybrid Fund. The fund delivered a negative -5.29%.

On the other end of the spectrum, IDBI Hybrid Equity Fund witnessed the least drawdown at (-24.49%), delivering 16.99% return in CY 2020.

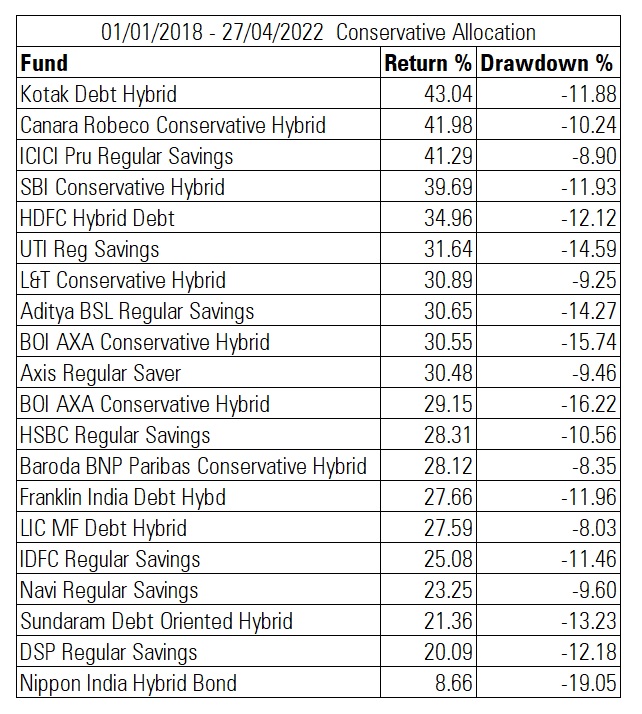

Conservative Allocation

These funds invest in the range of 75% to 90% of total assets in debt while the equity investment ranges from 10 to 25%. Nippon India Hybrid Bond Fund witnessed the largest drawdown (-19.05%), delivering -8.53% in the category. This was the only fund that was in red in this category in CY 2020. LIC MF Debt Hybrid saw the least drawdown at -8.03%, delivering 9.89% return during the same period. Kotak Debt Hybrid delivered the highest return in the category at 13.85% return.

This shows that investors should not go by just the fund nomenclature of being conservative. Depending on the fund’s strategy, style, and equity exposure, Conservative Allocation Funds can also deliver negative returns, although the downside protection will be comparatively better as compared to Aggressive Balanced Funds and Balanced Advantage Funds categories. The average drawdown in the Conservative Allocation category in CY 2020 was -11.15% as compared to -22.35% in BAFs and -29.14% in Aggressive Balanced Funds.

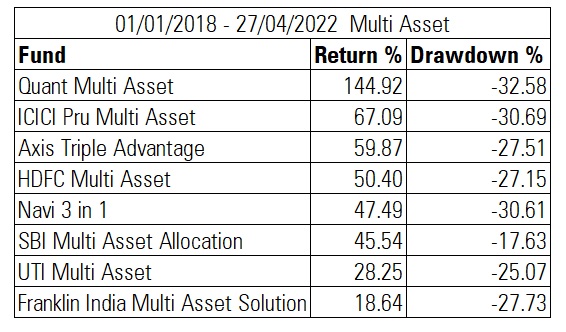

Multi Asset Funds

These funds invest a minimum of 10% in three asset classes: gold/silver, equity and debt. Even these funds were not completely immune to volatility. The highest drawdown was witnessed by Quant Multi Asset Fund (-32.58%) which delivered the highest return at 26.89% in CY 2020.

SBI Multi Asset Allocation Fund witnessed the least drawdown of -17.63%, clocking 14.22% in CY 2020.

What advisers have to say

Rushabh Desai, Founder of Rupee With Rushabh Investment Services, says that the core purpose of Balanced Advantage Funds/Dynamic Asset Allocation Funds is to provide consistency in returns, low volatility, and downside protection. He says that investors can have some allocation to this category. “To contain and reduce volatility and cyclicality and to avoid any other downside risks, one should select a fund which is skewed more towards large caps. It should follow a growth or blended strategy, more inclined towards growth, has high credit quality debt instruments, and has low to medium duration debt instruments giving higher allocation to low duration instruments which can be easily liquidated.”

Bengaluru-based Registered Investment Adviser Basavaraj Tonagatti says, “Even though these funds claim that they try to time the market in a better way, past history shows that these funds have not timed the market perfectly. Such funds can offer some downside protection but how far the fund manager will succeed is unknown. In the case of debt, there is no clarity on which type of debt instruments a fund manager can hold. This poses a little bit of risk.”