In part one of this series, we took a look at equity funds that carried high star ratings a few years back but later got downgraded, because of patchy performances later.

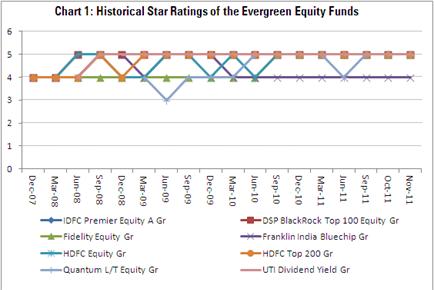

Here we highlight equity funds that are not just rated four or five stars currently but those that have also generally managed to hold on to their high star ratings over the years. Let's call them the evergreen equity funds.

The Morningstar star rating is arrived at by calculating a fund’s historical risk-adjusted performance across several timeframes such as three-, five-, and 10-year periods etc, with the largest weights given to longest-available period, compared to peers in the same category. The metric is a backward-looking quantitative assessment, and does not reflect our qualitative assessment of the fund.

While a fund with a high star rating--means it has racked up an impressive performance historically--it may not always mean the fund will go on to deliver superior returns in the future (see the previous article). However, below are funds that did.

Funds on this list (not exhaustive) not just have a good overall long-term record but have consistently outperformed across bull and bear market phases--the latter being especially important as several high-flying performers in a rising market tend to get battered in a down market, thanks to the excessive risk they took.

Click to view table for each fund's detailed performance over the years.

IDFC Premier Equity A: This mid-cap equity fund has consistently beaten peers within its group over the years. Its ability to capture gains in a rising market and limiting losses in a down market has helped it deliver superior risk adjusted returns over time.

The fund's strategy to stop lump-sum subscriptions to prevent short-term money from flowing into the fund, when the manager perceives valuations to be stretched has also worked in its favour.

HDFC Equity/HDFC Top 200: Barring a lukewarm 2006 and 2007, both the heavyweight large-cap funds have been consistent performers over the years. Their long term track record stands rock-solid, beating over 90% of the peer large cap funds over a 10-year period.

Investors’ faith in both these funds reflects in the stellar growth in asset size over time--both funds are about a mammoth Rs 10,000 crore each.

DSP BlackRock Top 100 Equity: This large-cap fund has landed in the first or second quartile in almost every year in the past few years. The fund has been one of the least volatile funds: it sports a “low” Morningstar Risk Rating for a five-year period,

Fidelity Equity: The fund clocked an average showing in 2007, as it largely stayed away from momentum plays. However, it has managed to beat the category in most other years, and especially in 2010, when it emerged as one of the top performing large cap funds.

Fidelity Equity’s assets may still be lower than its peak at the end of 2007, but over a five-year period, it beat 90% of peers.

UTI Dividend Yield: The fund has stuck to its mandate of investing a large part of the portfolio in high dividend-yield stocks, which has helped to protect the downside in falling markets.

The silver lining has been its ability to also deliver stand-out performances in the bull market years, except a blip in the year 2006, when it was one of the bottom performing funds within the category.

The fund has also changed its strategy a bit, increasing allocation to large cap stocks, unlike most other dividend yield which maintain higher allocation to mid / small cap stocks.

Quantum Long Term Equity: After a disappointing 2007, this equity fund has delivered knock-out performances in each of the following years.

The fund adopts a buy-and-hold strategy and unlike most other equity funds, it is fully invested during market downturns and increases its cash holdings when markets run up. The strategy paid off both during the 2008 fall and the subsequent rebound in equities.

Despite being a top-rated fund and a consistent performer, the fund’s assets, at about Rs 85 crores for the quarter-ended September 2011, looks small relative to some of its peers.

Franklin India Bluechip: This heavyweight large-cap fund has a long and steady performance track record, and does not shy away from making some contrarian bets, or exiting stocks where it feels that valuations have turned expensive. The strategy hurt the fund in the momentum-driven markets of 2007 (when it lagged 80% of peers), but worked well since.

Although its overall Morningstar Star Rating dropped to 4 stars, it has managed to beat about 80% of its peer large cap funds in the past 10 years--an impressive showing.

Later in this series, an article on funds whose star ratings climbed over the years, and relatively new funds that have achieved top star ratings.