In the final installation of a three-part series, we move on to highlight funds whose star ratings have climbed over the years and also recently-launched funds that have attained good star ratings because of impressive performance in the period since their launch.

Earlier, we wrote about funds that had high star ratings earlier but lost them later, and those that held on to their high star ratings over time.

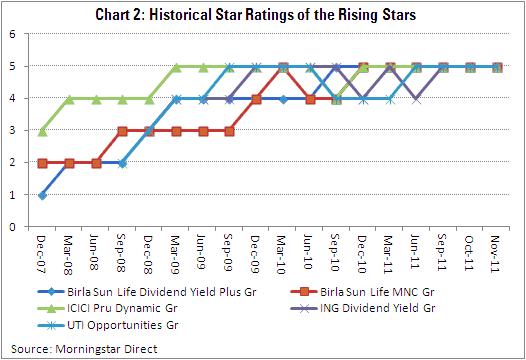

Rising stars

For this, we took end 2007 as the starting point for our analysis , before the global financial crisis wreaked havoc over equities (provided the fund was rated then).

These funds have typically managed to tide through the market volatility resulting since, and seen their performance improve over time.

A key point to note is the ability of these funds to provide downside protection in the market fall of 2008 and again in 2011.

As a result, some five-star funds featuring on this list are dividend-yield funds.

Click to view table for each fund's detailed performance over the years.

Birla Sun Life Dividend Yield Plus: After a disappointing 2005 and 2006 (where it featured in the bottom 10% of funds in the category), and a mediocre 2007; the fund showed its mettle in the market fall of 2008 and again in the volatile years of 2010 and 2011. As a result, it climbed the ratings ladder from 1 in 2007 to 5 stars currently.

The fund typically managed to deliver average returns in a bull market, but its true strength lies in navigating bear markets and protecting the downside risk--a strategy that worked for dividend-yield funds.

Birla Sun Life MNC: This relatively-unknown offering was rated 2 stars at the end of 2007 but is now a 5-star fund.

After a bleak performance between the years 2005 and 2007, the fund’s performance picked up thereafter, especially standing out in the down markets of 2008 and 2011.

Its objective states it will invest in stocks of multi-national companies (MNCs) in growth-driven sectors like FMCG, pharmaceuticals, auto and ancillaries, etc.

The fund’s overweight position in defensive sectors like FMCG and pharmaceuticals, and its underweight position in the industrials sector worked to its favour, especially in the turbulent markets of 2008 and 2011.

ICICI Prudential Dynamic: The fund has typically delivered reasonable returns in bull markets, but stands out in bear and volatile markets, where it has managed to limit its downside--benefiting from its dynamic strategy of increasing allocation to cash and debt instruments.

A good example is the market downturn of 2008, when the fund beat 96% of peers . The fund had a disappointing 2007 and was sporting a 3-star rating then; but performance has picked up since then.

ING Dividend Yield: In 2006, this was one of the worst performers in the category. But in 2009, it delivered tripe-digit returns and beat 97% of peers. It has also done reasonably well in down or choppy markets.

Historically, the fund has maintained a larger part of its portfolio in mid- and small-cap stocks, but since the latter half of 2010 it has started increasing exposure to large-cap stocks quite significantly.

Despite the substantial improvement in its performance, its assets remain considerably low at only Rs. 96 crore for the quarter-ended September 2011.

UTI Opportunities: After a dismal show in 2006, this fund has recovered in its performance smartly, with its Morningstar star rating rising from 2 stars in July 2008 to 5 presently.

The fund did well in the bull-market years of 2007 and 2009, as well as in the market downturns of 2008 and 2011.

In 2011, the fund was one of the best performers, delivering a return of about -12%, compared to the Sensex’s fall of more than 24%.

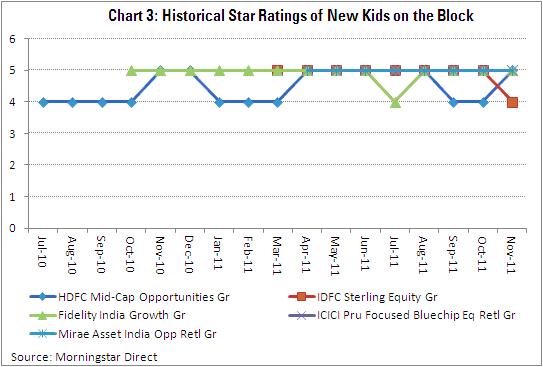

New Kids (Stars) on the Block

These funds have a relatively smaller track record, but have managed to start with high star ratings (four or five) in recent times.

It must be mentioned that for a fund to get a Morningstar star rating, it needs a minimum 3-year track record. So by those standards these funds have already managed to somewhat establish their performance.

Click to view table for each fund's detailed performance over the years.

HDFC Mid-Cap Opportunities: The fund has seen its star rating in the range of 4 or 5 stars, since the first rating was issued by us in July 2010. It has managed to deliver a good show since its launch in June 2007, despite a mediocre performance in 2009 (when it lagged almost 60% of its peer funds).

The fund’s ability reflects in its upside-capture ratio (ability to capture an index’s gain) of 98% and low downside-capture ratio (tendency to capture index’s losses) of 68% over a 3-year period, versus the CNX Mid Cap index.

IDFC Sterling Fund (earlier known as IDFC Small & Mid Cap Fund): Launched in February 2008, this small/mid-cap equity fund has displayed a decent enough track record till now, although 2011 was not very rewarding.

It started with a Morningstar star rating of 5, and then fell to 4 in November 2011.

Fidelity India Growth: Launched in September 2007, this large-cap equity fund has done well across market cycles, with performance especially standing out in 2010.

The fund has secured a 5-star Morningstar star rating since the first rating was issued in October 2010.

ICICI Prudential Focused Bluechip Equity: Launched in May 2008, this fund follows a focused strategy of investing in a handful of 20 large-cap stocks. It may increase the number of stocks to invest in beyond 20 once its asset-size grows beyond a certain mark.

The fund benefited as it was launched when the financial crisis and the correction in global markets were already underway, and it was able to hold on to cash for some time.

Even after 2008, the fund continued with its good performance, capturing the surge in markets in 2009, and at the same time limiting the downside in 2011.

This is further ratified by its high upside-capture ratio of almost 100%, and a low downside-capture ratio of 68% over a 3-year period. Its assets have grown by a mammoth 485% between June 2008 and September 2011.

Mirae Asset India Opportunities: Launched in March 2008, this equity fund has managed to impress as one of the top-performing funds in the large cap category over 3 years.

Performance stood out in the market rally of 2009, and then again in 2010. However, the fund is quite volatile and has a “high” Morningstar Risk rating over 3 years.

It has a significantly higher upside-capture ratio over 3 years, but its downside-capture ratio is also somewhat higher than the other funds discussed above.