Over the past year, around five well-known asset managers exited their respective fund companies. Most had undergone a fairly long stint with their respective employers and also established impressive track records in the funds they managed. So it was not surprising to find investors and advisers panic a bit at the exit.

Essentially, when a fund manager exits, two important questions crop up:

- Should fresh investments in the fund or ongoing SIPs be terminated?

- Should the current investment stay as it is or does it make sense to redeem and park the money elsewhere?

Frankly, there is no standard operating procedure to tackle this situation as the reading would be different for each case. Every manager exit will have its own implications. Instead of panicking and beating a hasty exit, here is how investors and advisers need to address the situation to arrive at a prudent decision.

When K N Sivasubramanian retired as CIO – Equity at Franklin Templeton Mutual Fund early 2014, it appeared to be a major hit to the fund house.

But those who had a fairly good grasp of the working culture at the AMC and the entire investment process would not have been perturbed. Franklin Templeton is known for its well-established and stable investment team and process-driven investment approach. The fund house over the years has displayed exemplary stewardship and investor focus.

Way before Siva’s exit, Anand Radhakrishanan was being groomed to fill in his shoes. Anand has been associated with the fund house since 2007 and has closely worked with Siva and the investment team. When he took over, the investing philosophy of the fund house was well ingrained into him and he was already a manager of note. Needless to say, the transition was seamless and the funds continued to deliver impressively.

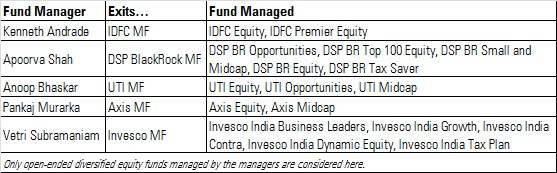

But such need not be the case for every AMC. When Sandip Sabharwal moved out of JM Mutual Fund, the fund house was not in a good position. When Kenneth Andrade exited IDFC Mutual Fund in July 2015, there was no one in the existing team to fill his shoes. Finally, Anoop Bhaskar was selected to take his place. When he moved out of UTI Mutual Fund, the AMC was headless for a while as far as an equity chief investment officer goes. Vetri Subramaniam has now been selected to fill in the slot, but there seems to be a gap in Invesco following his exit from Invesco.

Naturally, investors would get disconcerted when a prominent name leaves and there is no instant replacement (unlike a smooth handover in the case of Franklin Templeton). In such situations, redeeming investments may appear to be the easiest option, but not necessarily the best. Instead, one can put a stop to fresh investments and ongoing SIPs till more clarity emerges.

For instance, though IDFC Mutual Fund did take some time to replace its CIO slot, (expectedly - given it’s a big change), they did eventually get a superb replacement. Bhaskar is a seasoned manager with an extensive and successful track record. He has managed funds across market capitalizations with a reasonable degree of success over the past 12 years. Investors and advisers who waited could now make a more informed and sensible decision.

Consequently, there was no reason for investors to make any changes to their investments.

Now comes the vigilance.

After the new manager takes over, it is important to closely monitor the fund’s character. That too, over time (not all changes will be apparent immediately). For instance – a buy-and-hold approach may give way to a momentum -driven strategy. Or, a value style of investing may get replaced with growth. In such cases, while the fund’s broader investment strategy (market cap focus) may not change, the fund’s inherent nature and risk-return profile definitely gets altered.

One needs to ascertain if the fund continues to play the same role it did when selected for a particular portfolio. If the investment proposition alters, then it would be a good reason to consider exiting the fund and look at options more in line one’s risk-appetite and investment goals.

In conclusion…

Clearly, a fund manager exit is an important event. Here are three issues to address when deciding on your strategy.

- Was the fund house’s success dependent on the star fund manager or was it a team-driven and processes-driven effort?

- Who has been selected as the replacement? Does s/he have a good track record?

- Has the fund specific strategy changed with new leadership at the helm?

While gauging the impact of the above could be a tedious task, investors would do well to seek assistance from an investment adviser to decide the best future course of action.

Most important of all, don’t make hasty decisions.